On today's episode of HR over coffee, we're talking about post-termination employer issues and responsibilities. The discharge of an employee does not necessarily end the employer's relationship with or obligations to the employee. Benefits provided by the employer, as well as benefits mandated by law, may, in fact, cause that relationship to continue. Areas in which the former employee may have an ongoing connection to the employer include federally mandated Cobra or state continuation of health care coverage, providing a HIPAA certificate of creditable coverage through an employer-sponsored group health plan, severance pay if paid over a period of time and not as a single lump sum, and benefits to be paid through a qualified retirement plan. Federally mandated Cobra continuation of coverage is a key area that may extend the employer's obligation. The federal Cobra statute requires employers with 20 or more employees who provide group health coverage to offer employees continued health coverage following termination and loss of coverage. Smaller employers may also have continuation coverage responsibilities under their state laws. It's important to learn which Cobra or state continuation of coverage laws apply to your company. Additionally, federal HIPAA statutes say that group health plans are required to issue a certificate of creditable coverage, verifying an insurance period of coverage. This may allow that individual to obtain new group coverage without having coverage for pre-existing conditions excluded. Another key area is severance or cash payment given by employers to employees who have been discharged. Sometimes severance is given in consideration for a release of claims by the employee. Severance is also often given to employees in conjunction with a reduction in force. There is no federal law mandating severance pay, but employers should consult employment counsel to be certain they don't have other legal obligations to pay...

Award-winning PDF software

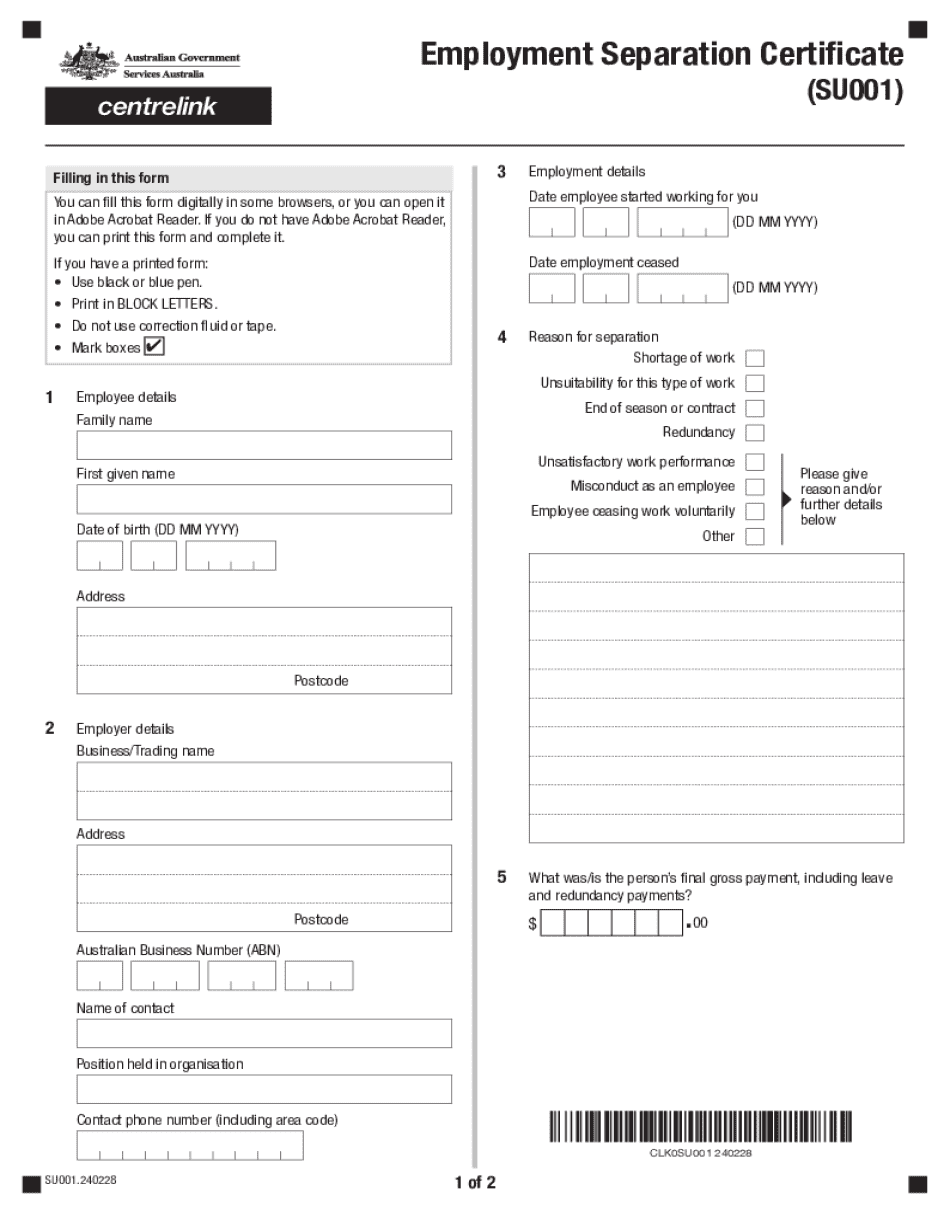

How do i get an Employment Separation Certificate Form: What You Should Know

Employment Separation Form (SU001) Instructions “I quit my job, therefore I am leaving this company and this company is terminating my service contract, therefore this company's employment contract is no longer valid.” (1) This should be followed by his reason of resignation such as: “I wish to retire as my employment situation does not allow me to continue for the foreseeable future due to my age.” This will be the final form that you are required to fill before you are considered to have left this company. Please note the following: 1) It's not recommended making any changes in the text or other forms during the sign-up process. It's best to keep the document to where it's written and complete only the sign-up and other instructions that you agree to in the first place. 2) You have the right to modify the form. However, if you do not agree with the changes you have made to the form, please do not sign the form and file a request. It will only take us 3 business days to respond to this request. 3) Form SU001 has an addendum to this document. To be included, the addendum should clearly outline the reason why the employee quit his job, the reasons why the employee is leaving this company and the reasons why the employee's employment contract is still valid. Please keep this addendum to the following letter which you'll sign and fill the appropriate spaces of the employment termination form: Employment Separation Addendum (To be completed only when it's required) A) REASON WHY _____ QUIT [Company Name] ___________ [Reason or reasons for leaving]: B) WHY I AM LEAVING [Company Name] [Reason You're Leaving]: C) CANCELLATION NOTICE ISSUED FOR [Reason or Reasons] D) HOW TO COMPLETE THE PROCESSING, ADDENDUM AND OTHER E) THE FORM AND ANY OTHER DOCUMENTS TO BE FILED WITH THE BINDING DOCUMENTS F) REFUND TO US FOR ALL APPLICABLE FEES AND SHIPPING TAXES 3) The process of leaving and filing an application for employment certificate is always a long process. Due to the large amount of documents you have to submit, it makes sense to create a checklist to help you get through the process in a Timely manner.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employment Separation Certificate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employment Separation Certificate Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employment Separation Certificate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employment Separation Certificate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How do i get an Employment Separation Certificate