Hi, my name is Pat Goodwin with Pat Goodwin Associates. Today, we're going to talk about how to manage separation, outplacement, and downsizing. This is critical to the value of the employee when tough decisions are being made. One key point that I've emphasized to the companies I've worked with is the importance of how the message is delivered to the employee and how they are exited from the building. These two factors can significantly reduce liability. In managing separation, outplacement, and downsizing, it must be handled with utmost confidentiality. If you haven't done it before, I suggest bringing in an expert consultant who has experience in delivering and formulating the message, as well as working with the legal team. Additionally, if there is a significant number of employees to be laid off, it's important to inform the Workers Compensation Center in advance. This announcement should be made ahead of time to ensure employees are aware of the impending layoff due to low numbers for the quarter. When it comes to conveying the proper message, if you want to keep the event confidential until the day it happens, meticulous organization is crucial. It is important to have trained managers who have gone through outplacement consultant training to practice and know what to say. They need to keep this information highly confidential. I've witnessed situations where individuals told their spouses in the evening, who then shared the news with others, leading to embarrassment the next morning. Trust in the person they confide in to not share the information is essential. HR needs to be prepared, arrive early on-site, and have all the necessary documentation and folders ready. During the separation announcement, it is crucial to mention the outplacement program and have consultants on-site to meet with the individual being let go. This allows them...

Award-winning PDF software

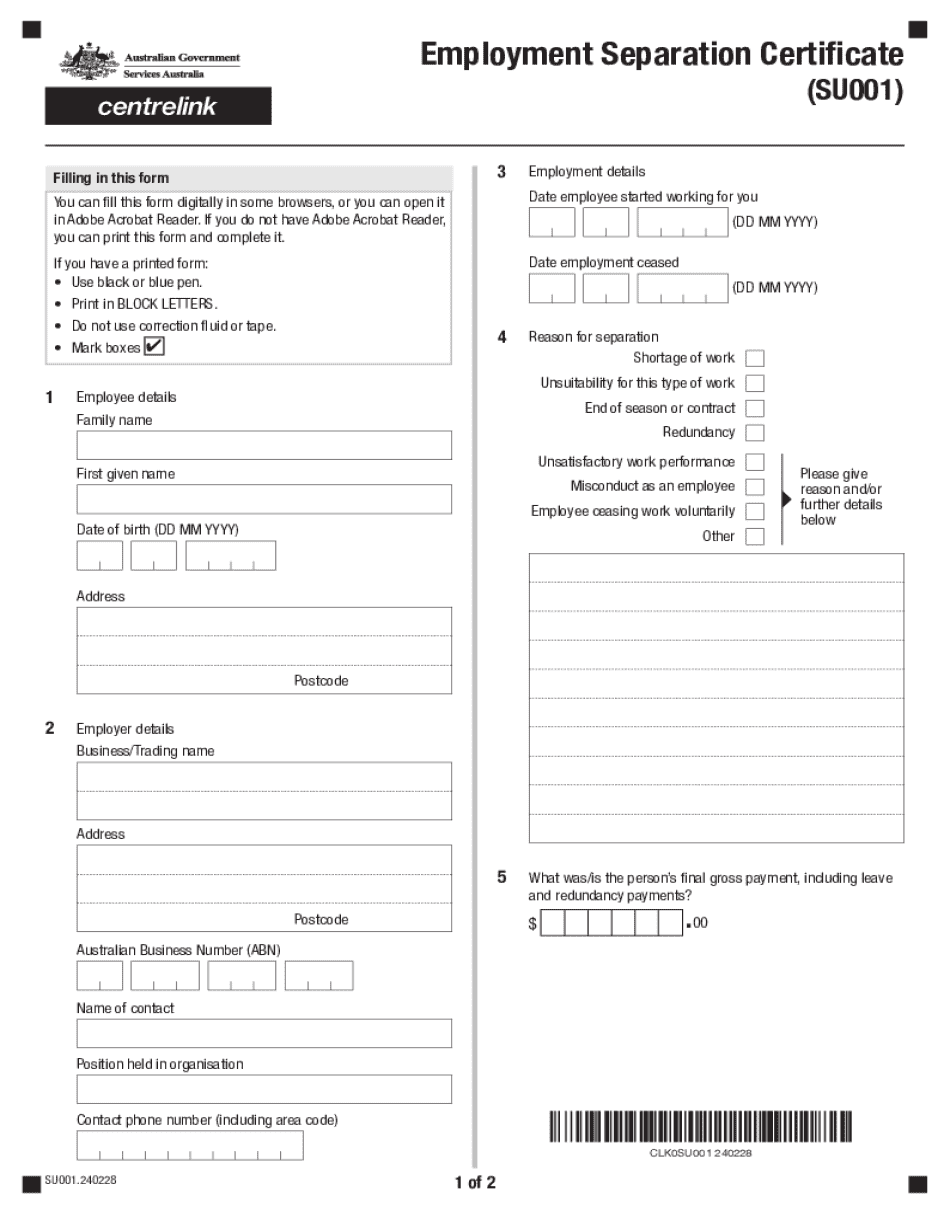

Do i need an Employment Separation Certificate Form: What You Should Know

If you choose to report counterfeit currency, complete the form and submit it to your local office. Report Counterfeit Currency. See OCC for further instructions. This form can be completed by any law enforcement agency, bank or cash processor to report counterfeit currency. If you choose to report counterfeit currency, complete the form and submit it to your local office. Report Counterfeit Currency. See OCC for further instructions. This form can be completed by any law enforcement agency, bank or cash processor to report counterfeit currency. If you choose to report counterfeit currency, complete the form and submit it to your local office. Report Counterfeit Currency. See OCC for further instructions. This form can be completed by any law enforcement agency, bank or cash processor to report counterfeit currency. If you choose to report counterfeit currency, complete the form and submit it to your local office. Report Counterfeit Currency. See OCC for further instructions. This form can be completed by any law enforcement agency, bank or cash processor to report counterfeit currency. If you choose to report counterfeit currency, complete the form and submit it to your local office. Report Counterfeit Currency. See OCC for further instructions. This form can be completed by any law enforcement agency, bank or cash processor to report counterfeit currency. If you choose to report counterfeit currency, complete the form and submit it to your local office. Report Counterfeit Currency. See OCC for further instructions. The form can be completed by any law enforcement agency, bank or cash processor to report counterfeit currency. If you choose to report counterfeit currency, complete the form and submit it to your local office. Report Counterfeit Currency. See OCC for further instructions. The form can be completed by any law enforcement agency, bank or cash processor to report counterfeit currency and must include each document submitted. If you wish to report counterfeit currency, submit this document via the Internet. ( ) 4. If you wish to be contacted by a USGS field office for an investigation, follow the instructions below: (5. If you would like to receive a U.S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employment Separation Certificate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employment Separation Certificate Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employment Separation Certificate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employment Separation Certificate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Do i need an Employment Separation Certificate