Greetings, this lecture is on employee separation. Specifically, how do we remove an employee from an organization? Sometimes it's voluntary and sometimes it's involuntary. We talked about issues of turnover earlier on in the semester. So, what we're going to get to now are the more challenging issues of when we have to make a decision to fire someone or lay them off. How do we go about doing that? As you guys know from the first slide, there are a multitude of reasons why people leave an organization. Sometimes it's voluntary and sometimes it's involuntary. Sometimes they're fired or they're laid off. So, it could be a variety of reasons. We also talked about HR planning and how we don't always have to make a hire or fire somebody. Sometimes we can do layoffs. Even if we choose not to do a layoff, there are other alternatives that we can use. For example, we can do a hiring freeze or we could have reduced work hours for everybody so that everyone takes an equal cut. We can transfer people, relocate them, or demote them. These are all ways that we can find a way to decrease our labor supply without it hurting the company in the long run. So, we have to make some really hard decisions about how we want to handle that. A layoff is very different than a firing. In a layoff, we let someone go but we give them the option to be rehired later. Usually, we lay somebody off because we're having economic problems or some other issues. But what we're really looking at is if they have been a good worker in the past and we like them, it gives us an opportunity to call them back. So, sometimes we have to make a layoff...

Award-winning PDF software

Separation of employment Form: What You Should Know

The agreement must meet the basic requirements for an employee separation agreement established by the NYC Labor Law. (Severance agreement signed by both parties for one position) You will need: NYC Labor law form DD215 for your position for your year or your most current employee's position. If the position has been vacant for six months for less than three (3) consecutive months and less than 6 months in any month, you will need (1) An employment agreement signed by both parties for the same position during a vacancy that was more than one (1) year. (2) A certified copy of any written severance agreement. You may obtain this agreement by contacting NYC Labor or by contacting our office. Include information as to: • The length of service to be terminated; • The duration of unemployment; • Length of leave (e.g., sick leave, vacation, etc.); • The reasons for the employment relationship to end. You may include your contact information, date of birth, and state your preference for having the employment relationship ended by the end of the calendar year for which the separation agreement is to be issued. You may include personal information such as current home address, phone number, and phone and fax numbers. The NYC Labor Law requires that employment agreements for six (6) month periods be delivered to NYC Labor at least thirty (30) Days prior to the first date of employment. Separately, you may submit an “Employment Agreement Supplement” to NYC Labor to request additional information if the termination was by mutual agreement, in lieu of a notice to terminate, and the agreement was not previously signed by either party. Please call 311 If an existing Employment Agreement is to be modified or amended in the future you must give NYC Labor, prior to the first date of employment, an “Employment Agreement Amendment Supplement.” When you sign the amended or revised agreement it cannot be used as the basis for an employment separation. Separate Employment Agreement-New York State Department of Labor Employer: Full name of Employer Date of separation; Employer Address; Date of start of employment; Occupational classification/role; Remarks; Reason for termination.

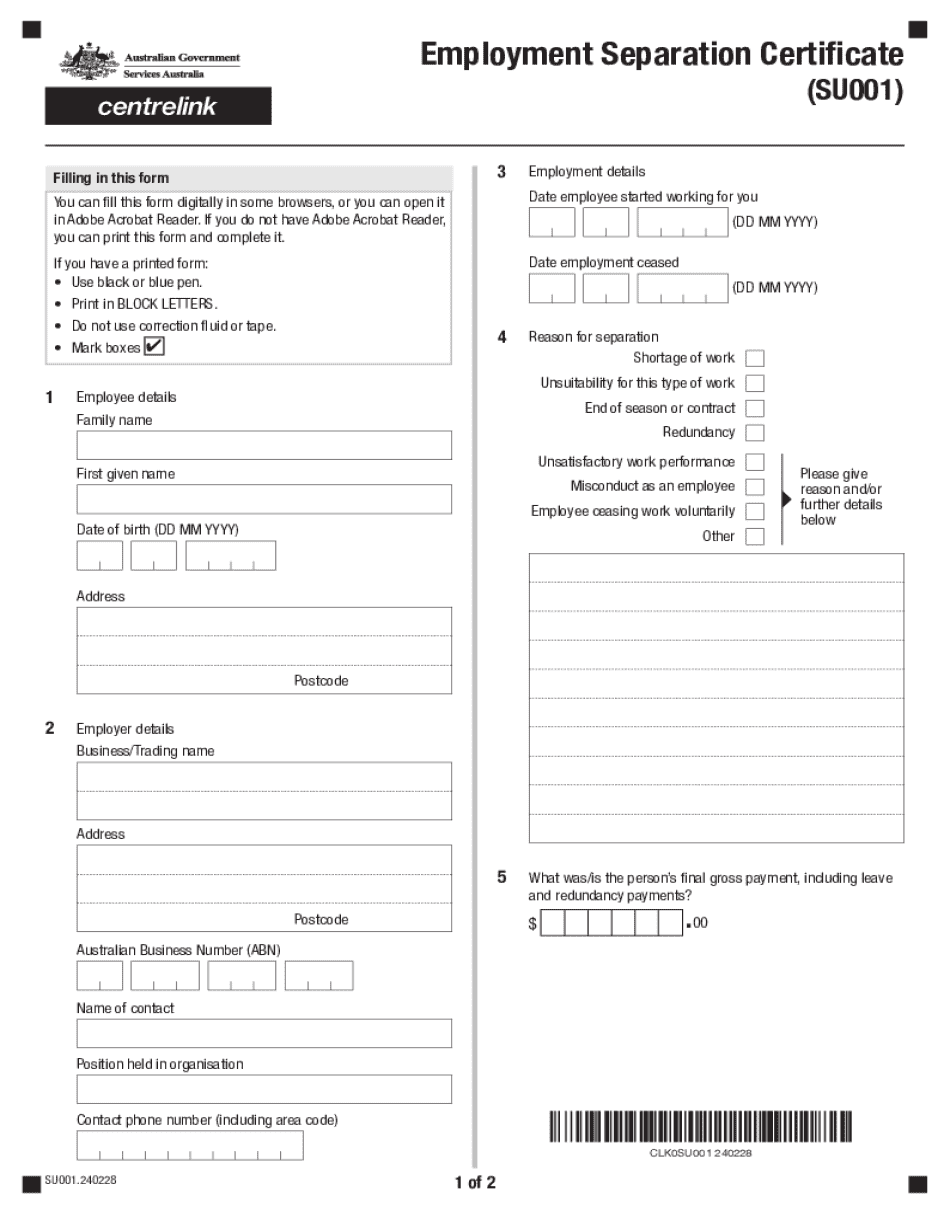

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employment Separation Certificate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employment Separation Certificate Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employment Separation Certificate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employment Separation Certificate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Separation of employment