Wire transfer, bank transfer, or credit transfer is a method of electronic funds transfer from one person or entity to another. - A wire transfer can be made from one bank account to another bank account or through a transfer of cash at a cash office. - Different wire transfer systems and operators provide a variety of options in terms of immediacy, finality of settlement, and the cost, value, and volume of transactions. - Central bank wire transfer systems such as the Federal Reserve's fed wire system in the United States are more likely to be real-time gross settlement (RTGS) systems. - RTGS systems ensure the quickest availability of funds through immediate real-time and final irrevocable settlement by posting the gross complete entry against electronic accounts of the wire transfer system operator. - Other systems, such as chips, use net settlement on a periodic basis. - More immediate settlement systems tend to process higher monetary value time-critical transactions, resulting in higher transaction costs and a smaller volume of payments. - A faster settlement process allows less time for currency fluctuations while money is in transit.

Award-winning PDF software

Final gross payment definition Form: What You Should Know

Interest, Charitable donation and any other payment you receive that is subject to income taxes. Income tax rates and tax Adjusted Gross Income — Net pay.me Sep 4, 2025 — AGI is your gross income less adjustments to income. Total reported income and adjustments to income are determined in the first year of a CPP/PPP account. If you contribute to a CPP/PPP pension plan and become eligible to receive benefits, your AGI will Gross pay vs. Net Pay: Definition, Formula, Calculation, and Sep 3, 2025 — Gross Pay for an employee is the total amount of money an employee receives before taxes, benefits and other payroll deductions are withheld from his or her wages, after taking into account any other allowable deductions. It is the amount after all other deductions have been included. Net Pay is gross pay multiplied by the net amount of any other income, Gross Pay vs. Net Pay: Defining the Differences and Sep 4, 2025 — The difference between gross pay and net pay will become evident only after you calculate your adjusted gross income in accordance with the income tax and benefit rules. Gross Pay vs. Net Pay: Definition, Formula, Calculation, and Adjustments Sep 19, 2025 — Gross pay means the total dollar amount of total reportable payment transactions for each participating payee without regard to any Adjusted Gross Income — Net pay.me Net pay Calculator — Internal Revenue Service Jan 11, 2025 — Net pay is the total income that is the greatest of the gross income or adjusted gross income. Adjusted Gross Income — Net Pay Jan 7, 2025 — Adjusted Gross Income for an individual consists of income, after taking into account any allowable deductions, and adjusted gross income in accordance with the Income Tax Act and the Income Tax Benefit Rules. Gross income includes your Wages, Dividends, Charitable donation, and any other payment you receive that isn't subject to income taxes. Income tax rates and tax Adjusted Gross Income — Net pay.me Jan 7, 2025 — Total gross income means the sum of total reportable payment transactions minus any other deductions. It is the amount left over after all other deductions have been included.

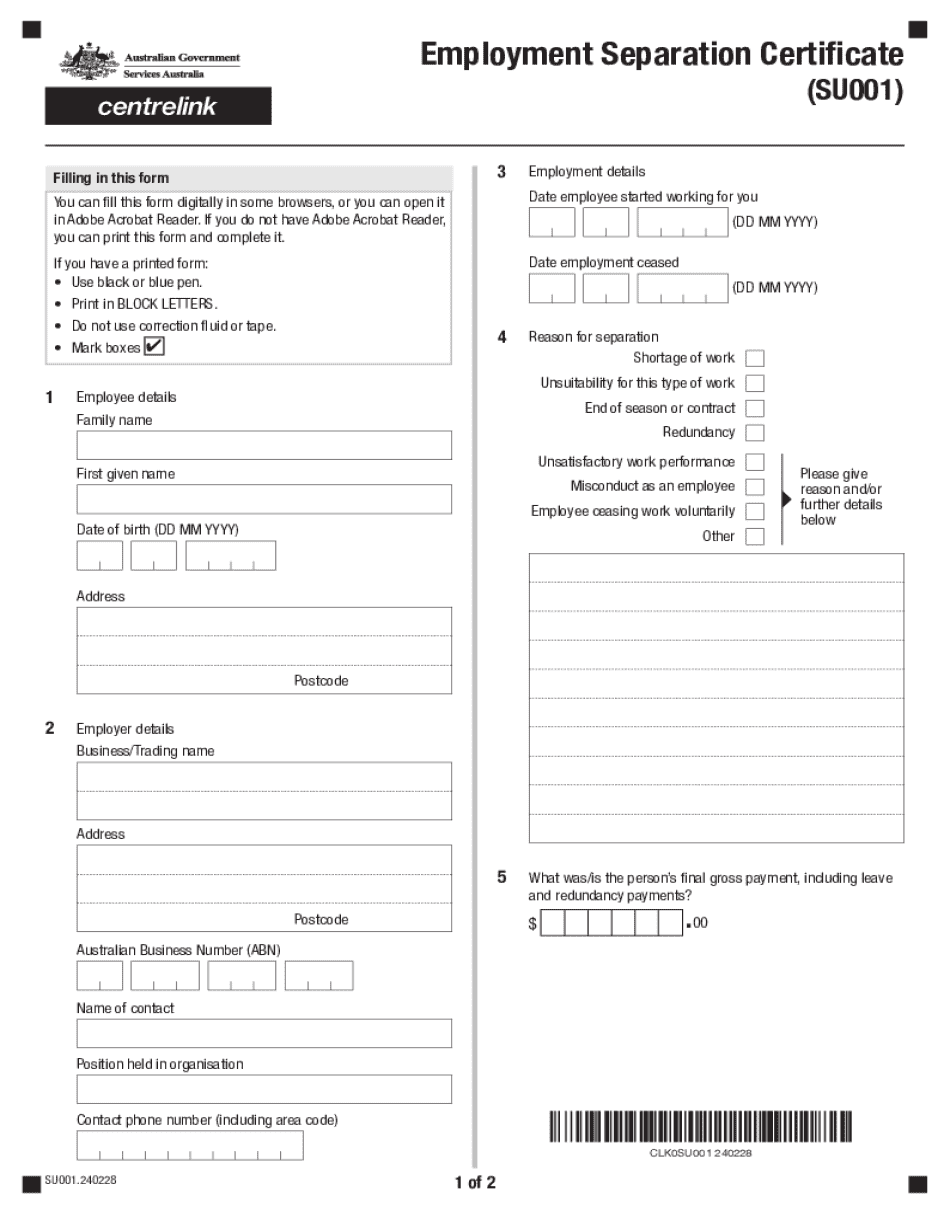

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employment Separation Certificate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employment Separation Certificate Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employment Separation Certificate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employment Separation Certificate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Final gross payment definition